27-Apr-2023

Why Tesla net income drops more than 20% from the last year

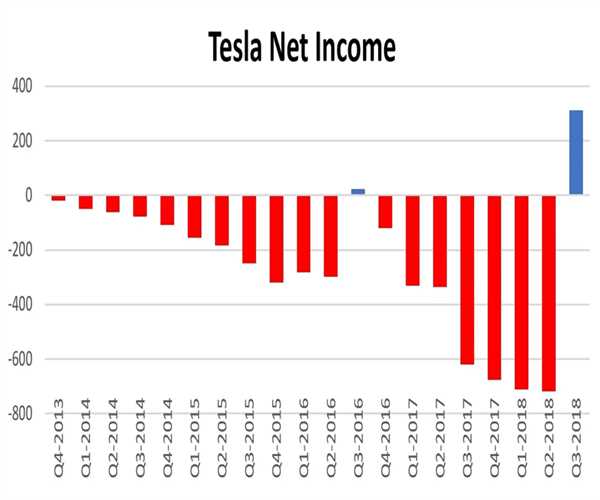

Tesla Inc., the leading electric car manufacturer, reported a net income drop of over 20% from last year's earnings in its Q3 2022 earnings report. This was a significant shock to investors who had high expectations for the company's continued growth and profitability.

Profit per share: 85 cents extra compared to the 85 cents anticipated, as calculated by Refinitiv's average analyst estimate Revenue: Refinitiv forecasts $23.33 billion versus $23.21 billion. Net income was $2.51 billion, down 24% from the previous year, and GAAP earnings were 73 cents, down 23% from the previous year.

In a shareholder deck, Tesla stated that the company's earnings had decreased from last year due to "underutilization of new factories," higher costs for raw materials, commodities, logistics, and warranties, and lower revenue from environmental credits.

In the quarter, Tesla's core business of automotive sales reached $19.96 billion, an increase of 18% from the previous year. 24% more money was made. Income from car administrative credits during the initial three months of 2023 added up to $521 million, down from $679 million in the main quarter the year before.

Elon Musk, CEO, emphasized an "uncertain" macroeconomic environment on an earnings call that could affect people's plans for car shopping. Musk stated during a question-and-answer session with analysts that he anticipated a year of "stormy weather" for the economy. "Every time the Fed raises interest rates, that's the equivalent of an increase in the price of a car," he warned. Additionally, he stated that when the economy is uncertain, individuals typically postpone "big new capital purchases like a new car."

Twitter livestreamed Tesla's first-quarter earnings call, a first for the electric vehicle manufacturer. Elon Musk, Tesla's CEO, sold billions of dollars worth of stock in 2022 to pay for a $44 billion takeover of the social media company, where he also serves as CEO.

At the end of last year and into the first quarter of 2023, the company reduced the prices of its automobiles, including further reductions on Tuesday night. Tesla is also making ambitious plans for expansion and increasing capital expenditures at the same time.

Four electric vehicle models are currently available for purchase from Tesla, which has two vehicle assembly plants in the United States—one in Shanghai and one outside of Berlin.

Prior to the earnings call, shareholders submitted questions for management's consideration regarding the company's energy division, the company's trapezoidal Cybertruck, and the timing of a new Tesla model.

On the call, Musk said Tesla is currently constructing "alpha variants of the Cybertruck" on a pilot line. The organization means to deliver the Cybertruck at its Austin, Texas, manufacturing plant. Musk said he expects an occasion to start off Cybertruck conveyances in the second from last quarter of 2023.

In this view, we will explore some of the possible reasons for this drop in net income.

Supply Chain Disruptions

One of the main factors contributing to Tesla's net income drop is supply chain disruptions caused by the ongoing global pandemic. The pandemic has disrupted the global supply chain, leading to shortages of key materials and components needed for manufacturing electric vehicles. This has resulted in higher costs for Tesla as they struggle to secure the necessary parts to build their vehicles.

Increase in Raw Material Costs

Another factor contributing to Tesla's net income drop is the increase in raw material costs. The cost of key materials used in the manufacturing of electric vehicles, such as lithium and cobalt, has risen significantly in recent years. This increase in cost has put pressure on Tesla's profit margins, as they have been forced to pay higher prices for these essential materials.

Slowdown in Electric Vehicle Demand

Despite the growing popularity of electric vehicles, there has been a recent slowdown in demand for these cars. This slowdown is partly due to the global pandemic, which has led to economic uncertainty and reduced consumer spending. Additionally, the decrease in demand may be due to the increasing competition in the electric vehicle market, with more manufacturers entering the space and offering competitive products.

Decrease in Regulatory Credits

Tesla has been able to generate significant revenue from the sale of regulatory credits, which are issued to automakers who produce zero-emissions vehicles. However, as more manufacturers begin to produce electric vehicles, the value of these credits has decreased, leading to a decrease in revenue for Tesla.

Investments in Growth

Finally, it is important to note that Tesla's net income drop may also be due to the company's significant investments in growth. Tesla has been investing heavily in research and development, expanding its production capacity, and building out its infrastructure to support the growing demand for electric vehicles. While these investments are necessary for the company's continued growth and success, they do come at a cost, which may impact short-term profitability.

In conclusion, the drop in Tesla's net income can be attributed to a combination of factors, including supply chain disruptions, increases in raw material costs, a slowdown in electric vehicle demand, a decrease in regulatory credits, and investments in growth. While these challenges may impact the company's short-term profitability, Tesla remains well-positioned for long-term success as the demand for electric vehicles continues to grow.

SEO and Content Writer

I am Drishan vig. I used to write blogs, articles, and stories in a way that entices the audience. I assure you that consistency, style, and tone must be met while writing the content. Working with the clients like bfc, varthana, ITC hotels, indusind, mumpa, mollydolly etc. has made me realized that writing content is not enough but doing seo is the first thing for it.

Join Our Newsletter

Subscribe to our newsletter to receive emails about new views posts, releases and updates.

Copyright 2010 - 2026 MindStick Software Pvt. Ltd. All Rights Reserved Privacy Policy | Terms & Conditions | Cookie Policy