06-Apr-2023

What can we learn from Warren Buffett?

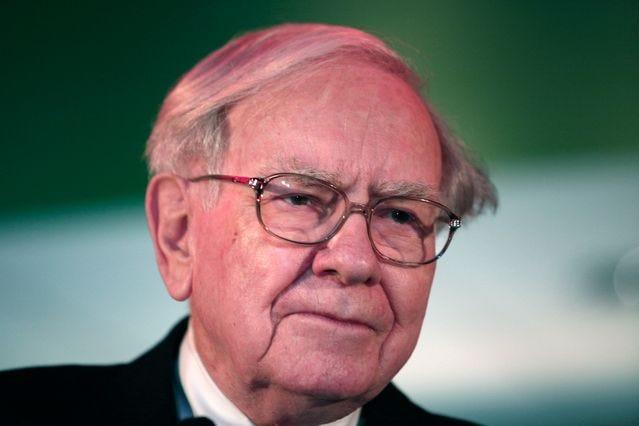

Warren Buffett is one of the most successful investors of all time. He is the chairman and CEO of Berkshire Hathaway, a multinational conglomerate holding company based in the United States. Known as the "Oracle of Omaha," Buffett has an estimated net worth of over $100 billion and is often referred to as a legendary investor. Buffett's investment philosophy has been widely studied and emulated, and there are several key lessons that we can learn from him.

Invest for the long term

One of the key principles of Buffett's investment philosophy is to invest for the long term. He once famously said, "Our favorite holding period is forever." Buffett believes in investing in companies that have a long-term competitive advantage and can withstand economic fluctuations. He avoids short-term market trends and focuses on long-term growth potential.

Focus on value, not price

Buffett is a value investor, which means he focuses on the intrinsic value of a company rather than its market price. He looks for companies that are undervalued by the market but have strong fundamentals and long-term growth potential. This approach has helped him to achieve consistent returns over time.

Conduct thorough research

Buffett is known for his meticulous research and due diligence. He spends a significant amount of time analyzing companies and industries to understand their long-term potential. He also looks for companies with strong management teams and a competitive advantage in their industry.

Avoid unnecessary risks

Buffett is known for his conservative investment approach. He avoids investing in companies that have high levels of debt or operate in volatile industries. He also avoids speculative investments and focuses on companies that have a strong track record of consistent performance.

Be patient

Buffett believes in being patient and waiting for the right opportunities to come along. He once said, "The stock market is a device for transferring money from the impatient to the patient." He is willing to wait for months or even years for the right investment opportunity to arise.

Stay humble

Despite his immense wealth and success, Buffett remains humble and grounded. He recognizes that investing is not an exact science and that he has made mistakes in the past. He is willing to admit when he is wrong and learn from his mistakes.

Give back to society

Buffett is a well-known philanthropist and has pledged to give away the majority of his wealth to charitable causes. He believes that wealth should be used to benefit society and has donated billions of dollars to causes such as education, healthcare, and poverty alleviation.

In conclusion, Warren Buffett's investment philosophy is based on principles such as investing for the long term, focusing on value, conducting thorough research, avoiding unnecessary risks, being patient, staying humble, and giving back to society. These principles can be applied not only to investing but also to other areas of life such as business and personal finance. By studying Buffett's approach, we can learn valuable lessons that can help us achieve success and make a positive impact on the world around us.

SEO and Content Writer

I am Drishan vig. I used to write blogs, articles, and stories in a way that entices the audience. I assure you that consistency, style, and tone must be met while writing the content. Working with the clients like bfc, varthana, ITC hotels, indusind, mumpa, mollydolly etc. has made me realized that writing content is not enough but doing seo is the first thing for it.

Join Our Newsletter

Subscribe to our newsletter to receive emails about new views posts, releases and updates.

Copyright 2010 - 2026 MindStick Software Pvt. Ltd. All Rights Reserved Privacy Policy | Terms & Conditions | Cookie Policy