04-Apr-2023

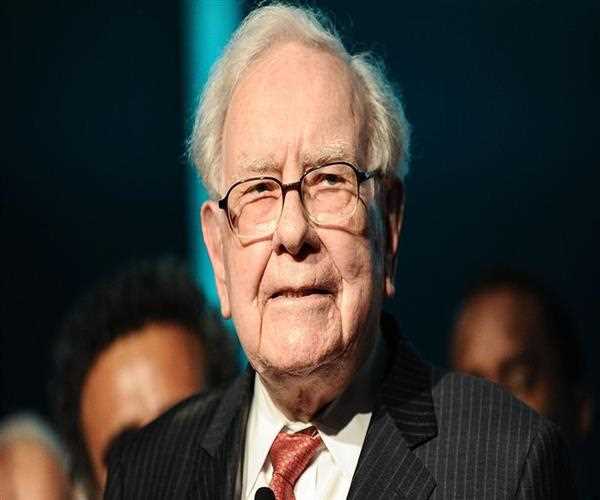

An early story of Warren Buffet- 2023 view

Warren Buffett, also known as the Oracle of Omaha, is a legendary investor and businessman who is widely regarded as one of the most successful investors in history. Born on August 30, 1930, in Omaha, Nebraska, Buffett's early life was shaped by his father, Howard Buffett, who was a stockbroker and investor. In this article, we will take a closer look at Warren Buffett's life story, his investment philosophy, and his legacy.

Early Life and Education:

Warren Buffett's interest in investing began at a young age, as he spent time with his father, Howard Buffett, learning about the stock market and investing. Buffett graduated from the University of Nebraska-Lincoln with a Bachelor of Science degree in Business Administration in 1950. He then enrolled in the University of Nebraska-Lincoln's graduate program in economics, but later transferred to the Columbia Business School to study under the renowned investor and economist, Benjamin Graham.

Investment Philosophy:

Buffett's investment philosophy is rooted in value investing, a strategy that involves buying undervalued stocks and holding them for the long-term. He learned this approach from his mentor, Benjamin Graham, who wrote the book, "The Intelligent Investor," which is considered a seminal work on value investing.

Buffett's investment strategy involves looking for companies that have a strong brand, competitive advantage, and a track record of generating consistent earnings. He also looks for companies with strong management teams and a history of paying dividends. Additionally, Buffett is known for his emphasis on investing in companies with a "moat," or a competitive advantage that makes it difficult for competitors to enter the market.

Buffett's investment style is also characterized by his aversion to risk. He has famously said, "Rule No. 1: Never lose money. Rule No. 2: Never forget rule No. 1." This approach has helped him to avoid investing in companies that are highly leveraged or have a history of poor management.

Investment Success:

Buffett's success as an investor is legendary, and he is consistently ranked among the wealthiest people in the world. His investment company, Berkshire Hathaway, has grown from a textile company with a market capitalization of $18 million in 1965 to a diversified conglomerate with a market capitalization of over $650 billion in 2022.

One of Buffett's most famous investments was his purchase of See's Candies in 1972. At the time, the company was a small candy maker in California, but Buffett recognized its strong brand and loyal customer base. He purchased the company for $25 million and has since turned it into a highly profitable business that generates hundreds of millions of dollars in annual revenue.

Another famous investment was Buffett's purchase of Coca-Cola in 1988. At the time, Coca-Cola was a well-established brand, but its stock price had been stagnant for several years. Buffett recognized the company's strong brand, competitive advantage, and track record of consistent earnings, and he purchased a large stake in the company. Today, Coca-Cola is one of Berkshire Hathaway's largest holdings and has been a major contributor to the company's success.

Legacy:

Warren Buffett's legacy as an investor and businessman is vast, and his impact on the financial world is immeasurable. He has inspired countless investors and entrepreneurs with his philosophy of value investing, and he has shown that it is possible to be both successful and ethical in business.

In addition to his investment success, Buffett is also known for his philanthropy. In 2010, he and fellow billionaire, Bill Gates, launched The Giving Pledge, which encourages the world's wealthiest people to donate the majority of their wealth to charity. To date, over 200 individuals and families have pledged to give away a significant portion of their wealth

SEO and Content Writer

I am Drishan vig. I used to write blogs, articles, and stories in a way that entices the audience. I assure you that consistency, style, and tone must be met while writing the content. Working with the clients like bfc, varthana, ITC hotels, indusind, mumpa, mollydolly etc. has made me realized that writing content is not enough but doing seo is the first thing for it.

Join Our Newsletter

Subscribe to our newsletter to receive emails about new views posts, releases and updates.

Copyright 2010 - 2026 MindStick Software Pvt. Ltd. All Rights Reserved Privacy Policy | Terms & Conditions | Cookie Policy