06-Feb-2023

What are Hindenburg’s allegations against Adani- Detailed Explanation

Overview

It’s amazing news for Indians how Asia’s richest man contributes to India’s GDP and economy.

I am talking about the great personality, of Gautam Adani.

Things are going very smoothly and adani is on a mission to expand his projects at the national as well as international levels.

Despite the fact that shocking news has come over it.

Even though Gautam Adani's business empire was building huge, there was still something shocking about it. When you're Asia's richest man, logic says the only way is down.

My Views:

A new investigation by Hindenburg Research has brought to light further revelations about the Indian conglomerate's activities.

Hindenburg is a research firm that has alleged that Adani, an Indian conglomerate, has been involved in fraudulent activities. Specifically, Hindenburg alleges that Adani has been inflating its revenue and profits, and has been using shell companies to hide its true financial status.

Hindenburg’s allegations against Adani have caused the stock of the conglomerate’s listed companies to plunge. This has led to investor losses and calls for regulators to investigate the matter.

Adani, an Indian conglomerate, is being accused of numerous financial crimes by Hindenburg Research, a short-selling firm. These include inflating the value of its Australian coal project, misleading investors about the true costs of the project, and using related-party transactions to funnel money out of the company.

Hindenburg has also accused Adani of bribing officials in India in order to secure environmental approvals for its projects.

Short-seller Nathan Anderson founded Hindenburg, which published a 100-page report alleging that the Indian conglomerate used a web of companies in tax havens to inflate revenue and stock prices while piling on debt.

Here are the points which are stated in the Hindenburg report:

Stock Market Manipulation with offshore shell companies: It found 38 shell companies in Mauritius that were owned by Vinod Adani, Adani's brother, or close associates, as well as companies he owned in other tax havens.

• It appears that earnings manipulation is the purpose of the offshore shell network.

Methods of operation: According to the report, Adani has a track record of questionable business practices, such as environmental violations and fraud. It also says that the company is using its political connections to get the Indian government to treat it well.

Governance of businesses: Hindenburg Research asserts that Adani lacks corporate governance and that Gautam Adani, the company's founder, exercises control over the business at the expense of minority shareholders.

Port operations: The report asserts that Adani has used its political connections to gain unfair advantages in the industry, and the port business is a significant part of the company's operations.

Concerns about the environment: Hindenburg Research asserts that Adani's proposed Carmichael coal mine in Australia poses a significant threat to the environment and that the company has a track record of violating environmental laws.

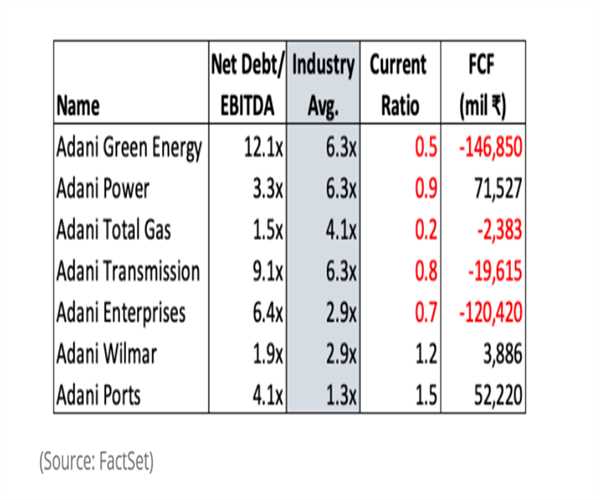

Business fueled by debt: Five of the seven key listed companies like Adani Total Gas, Adani Green Energy, Adani Power, Adani Transmission and Adani Enterprises mentioned has current ratios less than 1. This indicates that those businesses' total current assets are less than their total current liabilities.

Due to the fact that businesses are unlikely to have sufficient assets to pay off their liabilities in the near future, this is not a sound financial practice.

Artificial demand: The point here suggests that the Adani stock price was intentionally inflated by companies that appear to be biased toward (or connected to) the Adani Group. The delivery volume of Adani stocks may have been high due to possible wash trading, according to claims. purchase and sale of shares by the same or related parties to boost trading volume).

If I talk about the above points, there is the possibility that these allegations can be misleading and wrong as small firms cannot claim such information on the person who is contributing a massive growth in Indian economy and pushing India’s GDP. Why I am saying this because US people might be targeting our country to sharply hit India’s economic growth.

SEO and Content Writer

I am Drishan vig. I used to write blogs, articles, and stories in a way that entices the audience. I assure you that consistency, style, and tone must be met while writing the content. Working with the clients like bfc, varthana, ITC hotels, indusind, mumpa, mollydolly etc. has made me realized that writing content is not enough but doing seo is the first thing for it.

Join Our Newsletter

Subscribe to our newsletter to receive emails about new views posts, releases and updates.

Copyright 2010 - 2026 MindStick Software Pvt. Ltd. All Rights Reserved Privacy Policy | Terms & Conditions | Cookie Policy