23-Jul-2021 , Updated on 7/23/2021 7:26:53 AM

Food for thought: Thinking "Financially"

Life is a battle, either we could run away from it or participate in it- the choice is ours. How many of you align with this thought? If yes, then here is a recipe of words for your thought process.

Finance and managing money are important aspects of life. Whether we believe it or not, in the end, it is through proper implementation of our ideas only that we create an easy-going life. Financial planning is necessary for the smooth running of life. A happy person will be a healthy person, as they say- but financial problems in life can cause mental health deterioration.

How?

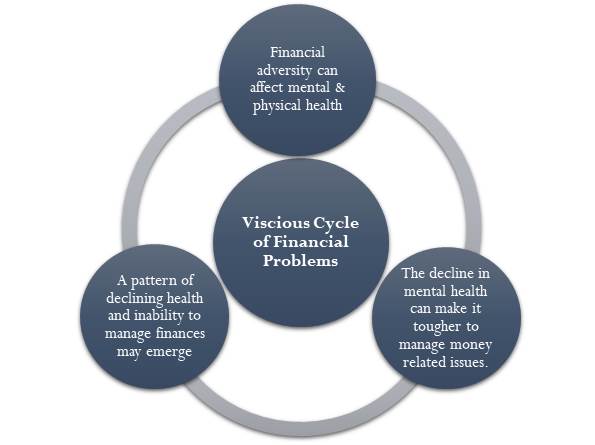

The building up of bad finances is a vicious cycle that may lead to other problems as well. Initially, it may start with poor budgeting habits- later the problem may start reflecting into other areas of life.

• It affects the behavior, working, and simulation of our relationships with others.

• Stress and anxiety are caused by poor finances as the person is always afraid of what to do next. The future seems scary to them and they can’t think of anything to do properly.

• Finding it difficult of how to manage things financially may affect our thinking, actions & other future possibilities.

• It can lead to relationship difficulties among couples as they could be in constant need of money and not getting any solution may affect their relationship dynamics with each other.

• People may start getting insomnia, hypersomnia, and social withdrawal conditions. Having low finances may want them to cut off from everybody and everything, shell into a cave- causing depression.

• Family worries and frustrations may arise because of the poor income system.

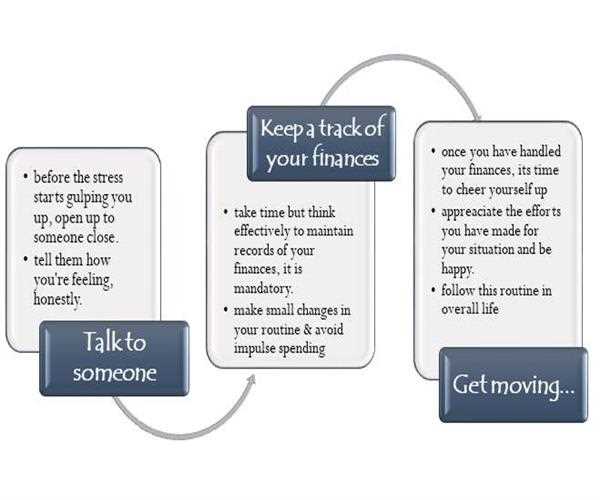

The best way to decline the effects of these financial problems is to follow a list of things:

Being financially independent is the dream of every young girl/boy. They are advised by the personal stakeholders of their life- parents, spouse, and siblings. However, financial literacy & learning to balance the ecosystem of money should be managed by the individuals separately. Money matters are real matters, and should be handled diligently.

There are many mental and physical problems that are the outcome of poor management of finances and no source of income. If we get stuck in the cycle of finance problems mentioned above it won’t be easy to get out of it any sooner. Just as your personal health, your financial health is also important to be monitored regularly. Also, if you’re in a better financial condition you would be able to provide for yourself in a better way.

People of the young age group who are dependent on their guardians for money should start looking out for income options that are morally correct, in order to learn financial literacy. Now many would ask, “Why at such a young age would teens require to earn?” Age is not a factor. The world is changing rapidly and new forms of lifestyle are emerging now. Thus, it is important for us to adapt to this change. If someone starts learning financial independence at an early age, it would be good for the demography of the country in the long run. The administration and financial systems would be handled by expert hands.

For help, read: Investment is the new 'piggy bank' for youth

Student

I am a content writter !

Join Our Newsletter

Subscribe to our newsletter to receive emails about new views posts, releases and updates.

Copyright 2010 - 2026 MindStick Software Pvt. Ltd. All Rights Reserved Privacy Policy | Terms & Conditions | Cookie Policy