Search here

16-May-2020

US States Badly Need Federal Funding To Fight Corona Pandemic

The COVID-19 pandemic has launch federalism to the highest point of the political motivation in America. Stood up to with the glaring absence of initiative from the Trump organization, state governments on the bleeding edges have assumed responsibility for the reaction.

Yet, with spending cutoff times for the new monetary year quickly drawing closer, numerous states face unforeseen deficits because of the emergency. In an ongoing letter to congressional pioneers, the National Governors Association mentioned an extra $500 at least billion in adaptable government financing, notwithstanding the $150 billion that was allowed for confined uses under the ongoing $2 trillion Coronavirus Aid, Relief, and Economic Security (CARES) Act.

In gauging this solicitation, Congress and the White House must decide if there is a legitimate macroeconomic basis for a noteworthy extra tranche of adaptable state financing and whether the government can bear the cost of it. The response to the two inquiries is a resonating yes.

However, US Senate Majority Leader Mitch McConnell, a Republican, has proposed that extra government subsidizing would add up to a bailout for prevalently "blue" (Democratic-controlled) states, and has contended that states in financial emergency ought to rather consider opting for non-payment. McConnell's intimation that state spending deficiencies are the consequence of iniquity is misdirecting and politically troublesome. Both red and blue states go up against colossal spending deficits that originate from declining incomes, not abundance spending.

State incomes are diving because of fundamental COVID-19 lockdown measures, which have set off a downturn more profound than any accomplished since World War II.

State governments are additionally bearing the greater part of the immediate expenses of fighting the infection, and sharing the expenses of controlling administrative security net projects, for example, joblessness protection and Medicaid, for which consumptions have risen significantly because of the emergency.

READ HERE MORE : Can We Really Blame Donald Trump For Corona Pandemic ?

In contrast to the government, state governments are compelled by adjusted spending laws. Without government assets to cover their approaching financial holes, they should raise assessments or execute profound spending cuts.

The macroeconomic method of reasoning for extra state help is subsequently basic and convincing. On the off chance that state governments are compelled to hammer on their monetary brakes, a great part of the advantage from the national government's own counter-cyclical boost estimates will be balanced, bringing about a superfluously more profound downturn, higher joblessness, and a more slow recuperation.

The exercises of the worldwide downturn 10 years back affirm these disturbing expectations. Somewhere in the range of 2008 and 2014, state governments endured a spending hit of about $600 billion, yet got just $150 billion in the administrative guide. State governments in this way needed to draw down their amassed save (blustery day reserves), increment assessments, and cut "optional" spending.

These severity measures were a noteworthy delay development. State governments had to decrease work in fundamental administrations, for example, instruction, general wellbeing, and emergency clinics, with an expected negative multiplier impact of 1.7 or increasingly (implying that each $1 of slices prompted a $1.70 loss of financial action).

More regrettable, somberness had durable impacts. Genuine (swelling balanced) state spending didn't surpass its pre-downturn top until 2019, and state and neighborhood payrolls didn't come back to their pre-downturn highs until the year's end, similarly as COVID-19 was developing.

Scarred by this injury, most states have step by step developed their blustery day assets to secure themselves against another surprising budgetary downdraft. In the 2019 financial year, these stores arrived at record-breaking highs in numerous states, and added up to a normal of 8% of state general reserve uses.

The issue, obviously, is that not even monstrous stormy day reserves are adequate to fill the tremendous budgetary gaps made by the COVID-19 pandemic. Nor is liquidation even a possibility for states. McConnell appears to have overlooked that the US Constitution restricts state governments from "impeding the commitment of agreements," including their own. On the other hand, regions do have a lawful option to default on some loans, and there is valid justification to stress that many might be compelled to practice it because of COVID-19, further destabilizing US and worldwide budgetary markets.

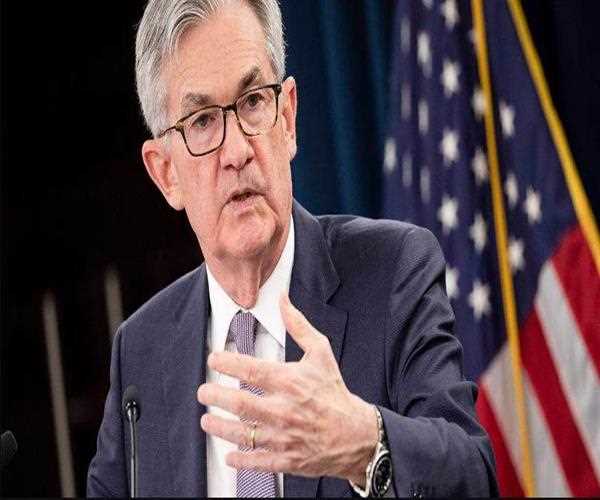

Dreading exactly that result, the US Federal Reserve has presented an uncommon $500 billion loaning office to screen the $4 trillion city security showcase. State and neighborhood governments rely upon this market to finance capital ventures like streets and schools and to connect transient holes among receipts and expenses.

Metropolitan securities have verifiably been a moderately sheltered, charge advantaged speculation class, in light of the fact that the paces of default by city backers have been low. In any case, since a large number of these backers' budgetary viewpoints have decayed, financial specialist concerns have risen, driving up metropolitan security yields.

Through the formation of its new Municipal Liquidity Facility (qualification for which has now been extended), the Fed has focused on buying billions of dollars of city securities at good loan costs, in this manner reestablishing steadiness to this market. In addition, the MLF is only one of numerous intense estimates executed by the Fed to balance out budgetary markets and give fiscal approach boost to fight the downturn actuated by the vital COVID-19 shutdowns.

The Fed has likewise cut strategy loaning rates to approach zero, propelled a boundless resource buy program for US Treasuries and home loan upheld protections, fortified the business protections markets utilized by organizations to raise transient money, and built up another Main Street Lending Program, utilizing CARES assets to loan straightforwardly to little and medium-size organizations. Attributable to these projects, the Fed's monetary record could arrive at a memorable high of 40% of GDP before the year's over.

Another significant improvement bundle, including in any event $650 billion in adaptable financing for state and nearby governments on the cutting edges of that war, is both moderate and basic. Federalism in obligations requires federalism in financing.

Content Writer/Journalist

I am a content writter !

Join Our Newsletter

Subscribe to our newsletter to receive emails about new views posts, releases and updates.

Copyright 2010 - 2025 MindStick Software Pvt. Ltd. All Rights Reserved Privacy Policy | Terms & Conditions | Cookie Policy