21-Apr-2020

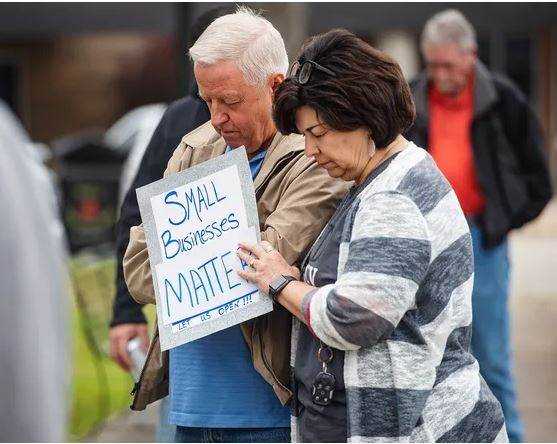

Small Business In USA Need Immediate Aid

Things are not working out in a good way for the administration's endeavors to help independent ventures and small businesses leveled by the coronavirus pandemic. No sooner had it started putting $350 billion in pardonable advances than it came up short on cash. What's more, a significant part of the cash has not really arrived at the independent ventures that need it so frantically. It is, actually, held up at banks battling to process the entirety of the applications and comprehend all the guidelines.

Fortunately the Trump government and leaders of the two parties in Congress state they are close to an arrangement to siphon an extra $300 billion into the program and $50 billion more into a related one. The awful news is that the program is excessively perplexing and is conflicting with progressively liberal bundles for large businesses endorsed in another segment of ongoing monetary alleviation enactment.

Undoubtedly, any alleviation program that is so enormous and made so rapidly will undoubtedly have glitches. In any case, the private company credit program — which is, in reality, all the more an award program — should be extraordinarily disentangled on the grounds that the legislature can either give crisis help to the economy or participate in financial social building. It can't do both.

Under the details of the Paycheck Protection Program, organizations can fit the bill for pardoning on the off chance that they utilize their 1% intrigue credits to pay the enthusiasm on costlier advances they may have, however not to settle the head on those advances. They can utilize their administration credits for lease and utilities, yet not to pay contractual workers or protection premiums. They should use in any event 75% of their advance on finance. Furthermore, they should go through this cash inside about two months of getting their credits, a prerequisite that bodes well yet overlooks the way that a few pieces of the nation are getting hit more diligently — or topping later — than different parts.

Banks have been entrusted with attempting to make sense of whether a candidate is probably going to follow these and different conditions. Of course, they have been overwhelmed to where numerous essentially aren't taking new applications. At any rate, two legal claims have been brought against banks, blaming them for preferring the bigger credit candidates, as opposed to handling ridiculously in.

Contrast this and the straightforwardness with which the administration has passed out money to a huge business in different pieces of the $2.2 trillion upgrade measure. Ten carriers, for example, have just concurred (respectable of them) to take $25 billion. Boeing evaluated a particular detail that could net the organization a $17 billion credit.

Huge organizations like these are getting cash since they are an advantageous path for the legislature to scatter cash and spare occupations in hard-hit enterprises, not on the grounds that they essentially merit it.

One explanation that carriers are in a shaky money related position is on the grounds that they utilized plentiful benefits of the previous decade to repurchase shares, climb profits and pay immense compensations to top administrators instead of to keep for later. Boeing, then, cut corners to get it's new 737 Max noticeable all around, just to see the armada grounded after two deadly crashes.

Small businesses need more cash and fewer guidelines. They represent about a portion of financial yield yet just got 16% of the $2.2 trillion upgrade bundle spent a month ago. Also, they're being made to go through the motions than less meriting huge organizations. That is not helpful for monetary recuperation. Small businesses need aid in this hour of utmost need and the Donald Trump government needs to ensure that the help is given hand to hand.

Content Writer/Journalist

I am a content writter !

Join Our Newsletter

Subscribe to our newsletter to receive emails about new views posts, releases and updates.

Copyright 2010 - 2025 MindStick Software Pvt. Ltd. All Rights Reserved Privacy Policy | Terms & Conditions | Cookie Policy